If you are looking for a comprehensive guide to the Space Applications market in the UK, then you are in the right place.

In this guide we cover:

- UK Space Applications in context: Market composition, income & growth;

- The decline of DTH Broadcasting: How Covid-19 has affected the largest segment of the Space Industry;

- UK Space Applications organisations: What they do and where/how to find them;

- The future of UK Space Applications: The technological innovations and public funding opening new opportunities for growth.

UK Space Applications in context

The UK Space Agency has estimated that satellite applications contribute an impressive £360bn to the wider UK economy, supporting nearly 17% of our national GDP.

This should come as no surprise: satellites deliver fundamental services, including navigation, weather forecasting, power grid monitoring, financial transactions, television services and digital communications, besides supporting national security operations and playing a key role in the global fight against climate change and biodiversity loss.

Capabilities developed in R&D Manufacturing are commercialised in the Applications segment by commercial users. These applications are:

- Direct-To-Home broadcasting (DTH),

- Fixed and mobile satellite communications services;

- Location-based signal and connectivity service providers;

- Supply of user devices and equipment;

- Processors of satellite data, applications leveraging satellite signals (e.g. GPS devices and location-based services) and/or data (e.g. meteorology, geographic information system software and geospatial products).

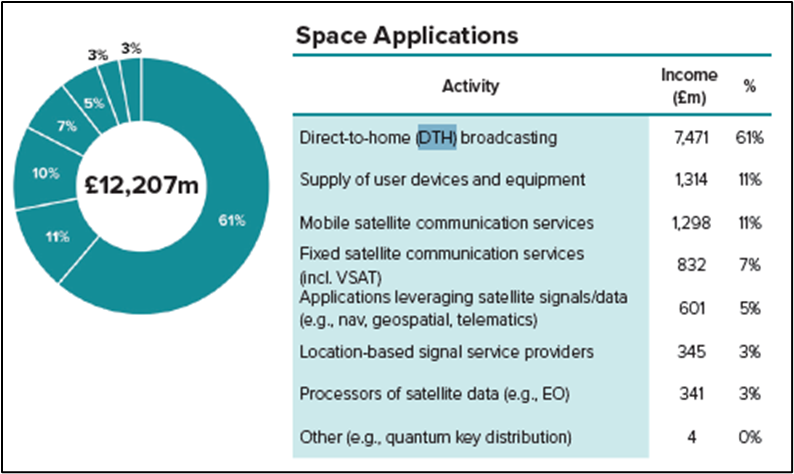

Space Applications composition & income, 2019/2020

Source: BryceTech, Size and Health of the Uk Space Industry 2021

Evermore important to the global economy is the widespread adoption of Global Navigation Satellite Systems (GNSS), which enable a wide range of positioning, navigation and timing (PNT) applications:

- GNSS (PNT) satellite services support £314bn of GDP (14.7%);

- Meteorological satellite services support £211bn of GDP (9.8%);

- Communications satellite services support £101bn of GDP (4.7%);

- Earth Observation satellite services support £100bn of GDP (4.7%).

Taking these numbers into consideration, it only makes that Applications is the largest segment of the UK Space economy.

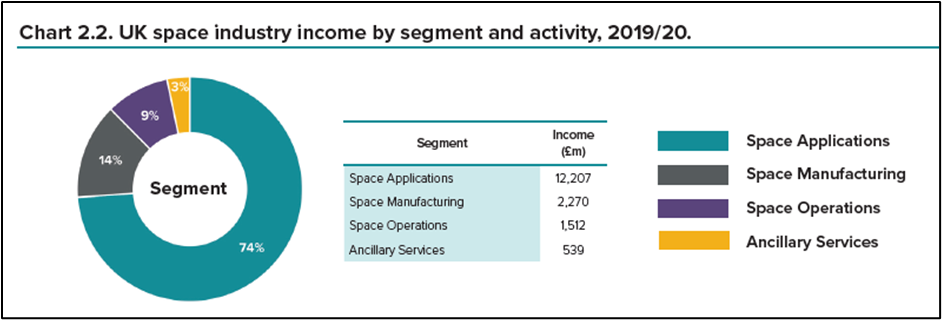

According to the latest data released by the UK Space Agency, in 2019/2020 Applications accounted for 74% of total industry income, up by 3% from 2018/2019.

UK space industry income by segment, 2019/2020

Source: BryceTech, Size and Health of the Uk Space Industry 2021

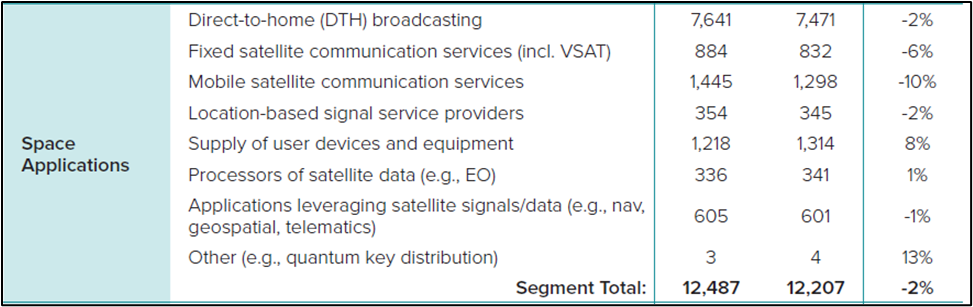

But while the Applications market had experienced steady growth up to 2018/2019, in 2019/2020 its overall income decreased by 4% (-£57m).

This drop, which in real terms accounted for £317m, was caused by reduced mobile satellite services (MSS) revenue and, most critically, reduced DTH services, the largest segment of the UK Space Industry.

Income growth by Space Applications segment between 2018/19 – 2019/20 in 2019/20 prices.

Source: BryceTech, Size and Health of the Uk Space Industry 2021

The decline of DTH Broadcasting

Historically, DTH broadcasting in the UK has dominated not only the Space Applications market, comprising 61% of its income, but the entire Space industry.

And yet, DTH income share fell from 52% in 2014/2015 to 45% in 2019/2020, partially due to the impact of the COVID-19 pandemic.

At the onset of the pandemic in early 2020, DTH service providers saw major sporting activities cancelled, suffering significant subscriber losses.

MSS organisations were also hit hard by the pandemic as key sectors like Aviation and Maritime experienced heavy disruptions.

Satellite communication companies have also been affected by long-term strains on turnover, especially the increased downward price pressure caused by the introduction of high throughput satellite connectivity.

Having said that, industry experts seem to agree that the decline of DHT is in fact a temporary bump along the way.

As DTH companies are gradually recovering from the financial strains caused by the pandemic, the DTH global market is forecasted to grow from $118.9bn in 2020 (£92.6bn) to $166.6 billion in 2025 (£129.8bn) at a CAGR of 7%.

UK Space Applications organisations

Space Applications is by far the largest employer in the UK Space industry, with DTH comprising 46% of the entire workforce.

Overall, more than 30,000 Britons are employed in Applications or two-thirds of the Space industry’s total workforce.

If you’re looking to get a foot in the Space Applications market, look no further: the UK Space Sector Landscape Map allows you to collect and download all the information you need to identify the key players and, potentially, your future business partners.

The map allows you to organize your search around four criteria:

- Satellite Applications Markets

- Company name

- Year of incorporation

- Number of employees

‘Satellite applications markets’ is the most interesting search tool, as you can use it to restrict your search by macro Space Application (Eo; PNT; Sat Comms) and wider-economy sector:

- Earth Observation (Eo): Agriculture & Food Security; Carbon Monitoring & Modelling; Climate Services; Construction & Engineering; Carbon Monitoring & Modelling; Disaster Resilience & Emergency Response; Energy; Environmental Monitoring Services; Government; Insurance & Finance; Mapping And Planning; Maritime (surveillance And Environment Monitoring); Meteorological; Remote Sensing; Security & Defence; Smart Cities & Integrated Urban Services; Transport Systems.

- Position, Navigation, and Timing (PNT): Automotive & Road; Aviation; Gaming, Augmented Reality & Simulation; General Timing; Health & Social Care; Indoor Navigation; Location-Based Services; Logistics; Maritime; Precision Agriculture; Rail; Scientific & Remote Sensing; Security & Defence; Smart Cities & Integrated Urban Services; Telecoms & Networks.

- Satellite Communications (Sat comms): Agriculture; Automotive & Road; Aviation; Broadband in Developing World; Broadcast – Live; Cellular Backhaul; Consumer Broadband; Direct to Home TV; Energy; Environment; Finance; Government; Health; Machine Learning/ Internet of Things; Maritime; Quantum; Rail; Seamless Personal Communications; Security & Defence; Uav / Rpas.

The future of UK Space Applications

The ‘downfall’ of DTH has led some industry experts to wonder about the future of Space Applications in the UK.

But it’s not all bad.

Although DTH did go down in 2019-2020, emerging applications such as quantum key distribution experienced a healthy degree of growth in the same time period.

And as the pace of technological progress shows no signs of slowing down – both on Earth and in orbit – the Applications market is bound to keep expanding in the coming years.

Emerging technologies like artificial intelligence, quantum computing and 5G network technologies are already prompting the development of new applications, services and whole new markets, such as precision agriculture, autonomous vehicles and drone-delivered parcel services.

All these technical innovations are heavily dependent on an intricate network of satellite infrastructure services, including precise and resilient positioning, up-to-date mapping, and continuous and reliable communications.

On top of that, the next few years will see the UK Government committed to increasing R&D investments to 2.4% of GDP by 2027.

At least £800m is going into setting up the Advanced Research and Invention Agency (ARIA), which will fund cutting-edge technologies and high-risk research across nine civil and defence capability areas: Satellite communications; Earth observation & intelligence; Surveillance & reconnaissance; Command-and-control, & space capability management; Space control; Position, navigation and timing; Orbital launch capability; In-Orbit servicing & manufacturing; Space domain awareness.

Further opportunities for growth are expected to come from the Ministry of Defence, which is looking to invest £5bn in satellite communication capabilities (Skynet) and a further £1.4bn in the acquisition and development of new technologies in space domain awareness, intelligence, surveillance and reconnaissance, command and control, and other new capabilities for national security activities.

If you want to learn more about the UK Space industry, check our recent series of articles:

A Beginner’s Guide to the UK Space Industry in 2022

UK Space Manufacturing: Present, past and future of a fast-growing sector!

Space Operations in the UK in 2002 and Beyond;

—

About JP Aero

We supply a wide range of space industry fasteners. Whether standard, metric or custom design we are leading UK experts.

We are AS9120 REV A & ISO9001:2008 approved and SC21 compliant.

Over the years we have built up a broad depth of knowledge around all types of fasteners in commercial aviation, heavy industry, oil & gas exploration, defence and now the space industry.

Our long-standing commitment to quality and service means that we work with some of the biggest organisations within the space industry, and we are available to share that expertise in our field with you.

To find out more about procuring small satellite fasters contact our team today and we will be happy to help in any way we can.

Photo by Bill Jelen