Welcome to our guide to UK Space Ancillary Services in 2022.

In this guide we cover:

● UK Space Ancillary Services in context: Market composition, growth & key players;

● The steep rise of Launch & Satellite Insurance and Brokerage: A look into one of the fastest-growing Space activities;

● The Future of UK Space Ancillary Services: Opportunities for future growth.

UK Space Ancillary Services in context

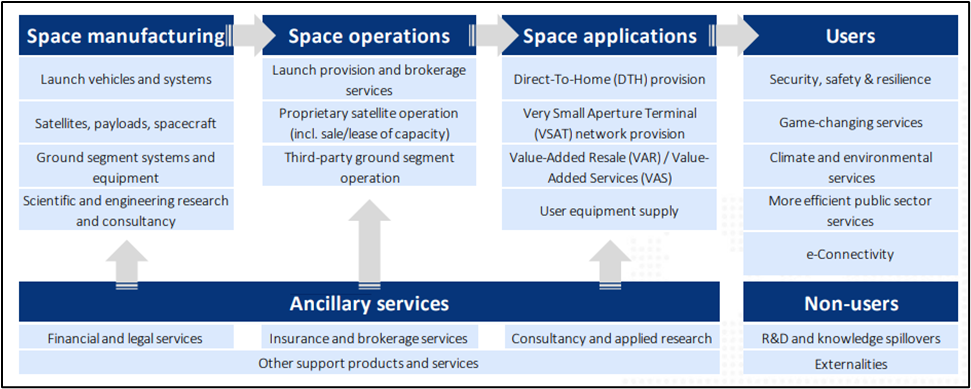

Ancillary Services companies provide the UK Space economy with a wide range of specialised support services, such as:

● Launch and satellite insurance (including brokerage) services;

● Financial and legal services;

● Software and IT services;

● Market research and consultancy services;

● Business incubation and development;

● Policymaking, regulation, and oversight.

UK Space economy value chain

Source: Space London Economics, Opportunities for Growth, UK Space Conference 2015

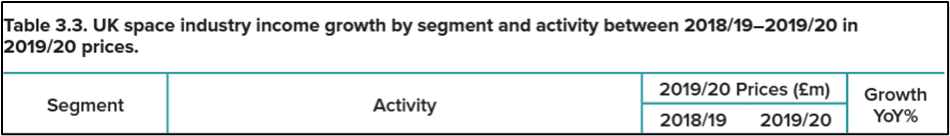

With an overall income of £539m, Ancillary Services is the smallest segment of the UK Space economy, lagging behind Applications (£12,207m), Manufacturing (£2,270m) and Operations (£1,512m).

However, while Operations and Applications experienced income losses (-4%; -2%), Ancillary Services grew by a healthy 4%, faring even better than Manufacturing (+1%).

The UK Space Agency estimates that there are 239 organisations providing ancillary services to the UK Space sector.

Here’s a breakdown of these organisations by service type:

● Consultancy Services: 127 organisations;

● Software and IT Services: 80;

● Market Research: 20;

● Financial and legal services:19

● Regulation and oversight: 9

● Launch and Satellite Insurance (incl. brokerage) services: 9

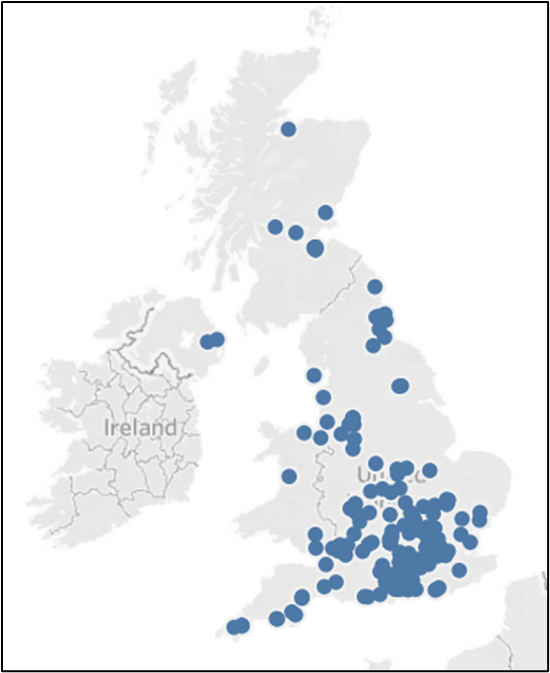

Ancillary Services organisations employ 2,830 people throughout the UK but are concentrated heavily in London and the South, as you can tell from this Innovate UK KTN map:

Geographical distribution of UK Space Ancillary Services Companies

Source: Innovate UK KTN, UK Space Sector Landscape Map

If you’re looking for specialised support services, look no further: the UK Space Sector Landscape Map allows you to collect and download all the information you need to identify the key players and, potentially, your future business partners.

The map allows you to organise your search around four criteria:

- Ancillary Services Market

- Company name

- Year of incorporation

- Number of employees

The steep rise of Launch & Satellite Insurance and Brokerage

One of the UK space activities that displayed the most significant growth in 2019/2020 was Launch & Satellite Insurance & Brokerage, which concentrates on pre-launch, launch and in-orbit risks.

Some of the key players in the UK include organisations like:

● Atrium Space Insurance Consortium

● Earth-i

● In-Space Missions

● Swiss Re Corporate Solutions Ltd

● ViVet Limited

● XL Catlin

Source: BryceTech, Size and Health of the Uk Space Industry 2021

The growth of Launch & Satellite Insurance and Brokerage in the UK (+25% +£20m) mirrors a global trend that has seen the combined insurance policy market for rockets and satellites total over 369m Euros (£313m).

Space Risk Management has grown dramatically ever since 2019, when NATO declared space an operational domain and governments throughout the world rushed to establish national Space Commands.

But 2019 is also the year of the European Vega rocket failure in French Guiana.

This incident led to the destruction of a US$200m satellite (£160m) and to the loss of twenty years of insurance premiums for pre-launch coverage.

And with satellite technology becoming more and more complex, effective risk management is now a key component to any successful launch operation.

For all these reasons, Insurance and Brokerage has been expanding besides the launch of a vessel and satellite to cover things like:

● Satellite in-orbit

● Spacecraft pre-transit, transit and pre-launch

● Satellite contingency

● Satellite launch vehicle flight

● Satellite in-orbit third-party liability

● Loss of revenue and business interruption

● In-orbit incentives (failure to meet contractual obligations)

● Production facility / launch pad property

The future of UK Space Ancillary Services

The future of Ancillary Services is heavily dependent on the growth of the other Space segments: Manufacturing, Applications and, most importantly, Operations.

In this respect, the future ahead seems promising.

Industry experts have been referring to 2022 as “the start of a new era in UK space affairs”, and understandably so.

Nearly half a century after the UK’s failure to launch its own Black Arrow rockets from Australian soil, the first satellite launch from the UK is finally taking place this summer as the Prometheus-2 is set for take off from Spaceport Cornwall in Newquay, Cornwall.

Hopes are that the horizontal launch in Cornwall will be followed by a vertical launch from SaxaVord Spaceport in Shetland, Scotland.

Run in collaboration with rocket company Skyrora, this mission is expected to generate an additional 16 launches a year in the next decade.

Opportunities for growth are also expected to come from the Ministry of Defence, which is looking to invest £5bn in satellite communication capabilities (Skynet) and a further £1.4bn in the acquisition and development of new technologies in space domain awareness, intelligence, surveillance and reconnaissance, command and control, and other new capabilities for national security activities.

About JP Aero

We supply a wide range of space industry fasteners. Whether standard, metric or custom design we are leading UK experts.

We are AS9120 REV A & ISO9001:2008 approved and SC21 compliant.

Over the years we have built up a broad depth of knowledge around all types of fasteners in commercial aviation, heavy industry, oil & gas exploration, defence and now the space industry.

Our long-standing commitment to quality and service means that we work with some of the biggest organisations within the space industry, and we are available to share that expertise in our field with you.

To find out more about procuring small satellite fasters contact our team today and we will be happy to help in any way we can.

Photo by NASA